Tokens, Cryptocurrencies & Other Cryptoassets

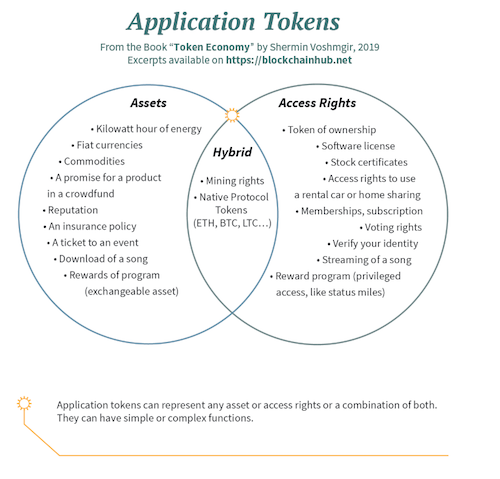

Cryptographic tokens represent programmable assets or access rights, managed by a smart contract and an underlying distributed ledger. They are accessible only by the person who has the private key for that address and can only be signed using this private key. Tokens might a ect the nancial world in the same way as email a ected the postal system.

While the existence of tokens in general and digital tokens, in particular, is not new, the speed with which these cryptographic tokens are being deployed and issued is an indicator that these tokens might be the killer application of blockchain many people have been waiting for.

While the existence of tokens in general and digital tokens, in particular, is not new, the speed with which these cryptographic tokens are being deployed and issued is an indicator that these tokens might be the killer application of blockchain many people have been waiting for. As of April 2019, and within less than a decade since the emergence of the Bitcoin white paper, an ecosystem of over 2200 publicly traded crypto assets are listed on Coinmarketcap and over a total of 175.000 Ethereum token contracts were found on the Ethereum main network. These cryptographic tokens are o en issued with just a few lines of code, using a simple smart contract running on a blockchain. These special types of smart contracts also referred to as token contracts, define a bundle of conditional rights assigned to the token holder.

Token contracts are essentially rights management tools that can represent any existing digital or physical asset, or access right to assets someone else owns. Tokens can represent anything from a store of value to a set of permissions in the physical, digital, and legal world. They facilitate collaboration across markets and jurisdictions and allow more transparent, efficient, and fair interactions between market participants, at low costs. Tokens can also incentivize an autonomous group of people to individually contribute to a collective goal. These tokens are created upon proof of a certain behavior (read more: Chapter 4 – Purpose-Driven Tokens).

The ability to deploy tokens at a low cost relatively effortlessly on a public infrastructure is a game-changer because it makes it economically feasible to represent many types of real-life assets in a digital way that might not have been feasible before. Examples could be fractional ownership of art or real estate. This might improve the liquidity and transparency of existing asset markets. It might also fundamentally impact our economic interactions, much more than might meet the eye at such an early stage of their existence (read more: Part 4 – Security Tokens & Fractional Ownership).

Digital assets are not a new thing, but cryptographic tokens on the blockchain have lower issuance and management costs involved. They can be easily issued and securely traded on a blockchain, without an intermediary or escrow service. Whereas state-of-the-art digital assets are controlled by centralized entities, they can now be issued with a few lines of code, and managed by a public and verifiable infrastructure like a blockchain. Tokens can provide (I) more transparency along marketplaces than with existing financial systems. This could significantly reduce fraud or corruption along the supply chain of goods, services, and financial transactions. Tokens also have the potential of (II) reducing transaction costs of developing, managing, and trading of cryptographic assets along distributed ledgers, than managing assets along state-of-the-art systems. This could lower barriers to create e cient marketplaces for products and services that are not currently tokenized, like art or real estate. The effects are (III) increased liquidity, lower costs of price discovery, and less fragmented markets for such products and services. This may result in (IV) completely new use cases, business models, and asset types that were not economically feasible before, and potentially enable completely new value creation models.

While more and more people are starting to create and invest into cryptographic tokens, the understanding of different token types out there is still limited, even among professional investors and seasoned members of the blockchain community. To add to the confusion, terms like “cryptocurrency,” “crypto assets,” and “tokens” are very o en used synonymously. The media mostly tends to refer to these new assets as “cryptocurrencies,” which is o en used to describe a diverse range of “crypto assets” or “tokens” that could represent anything from a physical good, a digital good, a security, a collectible, a royalty, a reward, or a ticket to a concert. I would, therefore, like to argue that the term “cryptocurrency” is not ideal, since many of these new assets were never issued with the intention to represent money in the rst place. “Cryptographic asset” would be a more generic term that one could use. The term “token” is also generic, but encompasses all tokens, not only asset-backed tokens. We can also see that with the rise of ICOs (Initial Coin O e- rings) and shi to ITOs (Initial Token Offerings) or STOs (Security Token Offerings), the term “token” has become somewhat omnipresent.

While a lack of clear, agreed-upon terminology and definitions is quite common in emerging domains, precision in language and terminology is a basis for informed decisions and better discourse. It is important to understand that we are still throwing around a set of overlapping terms to refer to more or less the same thing, and that generates much confusion when trying to make sense of these new phenomena. This chapter will, therefore, try to give a brief overview of the history and different properties of cryptographic tokens, from a technical, legal, and business perspective.

History of Tokens

Tokens are not a new thing and have existed since long before the emergence of blockchain. Traditionally, tokens can represent any form of economic value. Shells and beads were probably the earliest types of tokens used. Other types of tokens are, for example, casinos chips, vouchers, gi cards, bonus points in a loyalty program, coat check tokens, stock certificates, bonds, concert or club entry tokens represented by a stamp on your hand, dinner reservations, ID cards, club memberships, or train or airline tickets. Most tokens have some inbuilt anti-counterfeiting measures, which may be more or less secure, in order to prevent people from cheating the system. Paper money or coins are also tokens. Tokens are furthermore used in computing, where they can represent a right to perform some operation or manage access rights. A web browser, for example, sends tokens to websites when we surf the web, and our phone sends tokens to the phone system every time we use it. A more tangible form of computer tokens are tracking codes that you get to track your parcel with postal services, or QR codes that give you access to a train or plane. In psychology, tokens have been used as a positive reinforcement method of incentivizing desirable behavior in patients, especially in a hospital setting. Cognitive psychology uses reward tokens as a medium of exchange that can be exchanged for special privileges within the setting of a hospital stay.

Recyclable bottles are a good analogue example for a token. In some countries, bottles you buy in supermarkets are issued as tokens, as they have a recycling value of usually a few cents printed on them. This is money that you pay on top of the initial price of the product, and has become a method for governments to encourage the recycling of materials and subsequent reduction of litter in public places. If you return the bottle to the supermarket or other collecting entities, you will get reimbursed with the recycling value stated upon the token you return – the bottle. Losing the bottle is equivalent to losing money.

A garbage bag could also represent a recycling token if it is issued with a recycling value. In some parts of Switzerland, for example, you can’t just throw out trash in a bin in a random bag. You have to pay for the bag up front, which includes a dumpster fee, and you can only use those bags to dispose of your trash. As opposed to most other countries, where you pay your garbage bill monthly, as part of your utility bill tied to the rent of your apartment or house, this system requires you to purchase these special plastic bags. These tokenized plastic bags come at a higher cost than regular supermarket plastic bags, and are issued and managed by local authorities.

Cryptographic Tokens

In this historic context, cryptographic tokens on the Blockchain can combine both concepts: access rights to some underlying economic value (property) or a permission to access the property or services of someone else or collective good. This property or service can be public (Bitcoin Network) or private (an apartment that is rented out by a private person). It is important to note that the term “token” is simply a metaphor. Contrary to what the metaphor might suggest, a token does not represent a digital le that is sent from one device to the other. Instead, it refers to assets and/or access rights that are collectively managed by a network of computers, a blockchain network, or other distributed ledger. A distributed ledger provides a universal state layer, a public infrastructure in the form of a distributed record of transactions that keeps track of which wallet address is the owner of which token (read more: Part 1 – Web 3).

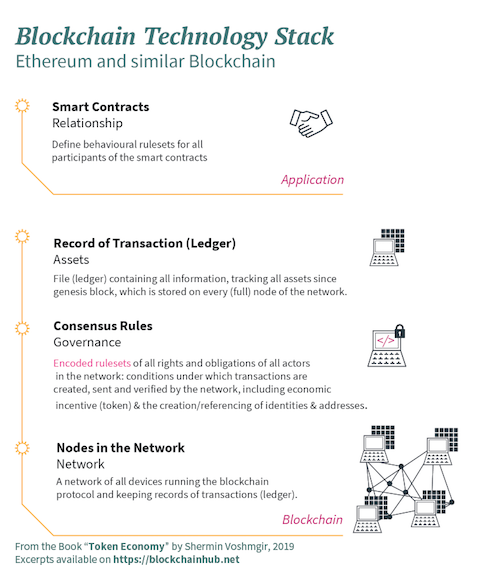

Cryptographic tokens represent a set of rules, encoded in a smart contract – the token contract. Every token belongs to a blockchain address. These tokens are accessible with a dedicated wallet so ware that communicates with the blockchain and manages the public-private key pair related to the blockchain address. Only the person who has the private key for that address can access the respective tokens. This person can, therefore, be regarded as the owner or custodian of that token. If the token represents an asset, the owner can initiate transfer of the tokens by signing with their private key, which in turn generates a digital fingerprint or digital signature. If the token represents an access right to something somebody else owns, the owner of that token can initiate access by signing with their private key, thereby creating a digital fingerprint. If the token represents a voting, the owner of that token can vote by signing with their private key, creating a digital signature (read more: Part 1 – Cryptography).

From a regulatory point of view, however, it is not definitively clear whether or how it is possible to acquire ownership or possession on such tokens. Therefore, concepts like custodianship would probably need legal modifications in many jurisdictions.

Tokens always need a substrate that ensures their validity, including some inbuilt anti-counterfeiting measure. Historically, tokens have been issued and managed by centralized entities, to ensure validity, and have had security mechanisms built into the substrate. Central banks issuing coins and bills need to make sure that their tokens, the coins and bills, are hard to copy. The same is true for a concert organizer issuing tickets to a concert. The validity and security of cryptographic tokens is managed by the smart contract that created it together with the underlying distributed ledger by majority consensus (read more: Part 1 – Bitcoin, Blockchain, & Other Distributed Ledgers).

The first blockchain tokens were the native tokens of state-of-the-art public & permissionless blockchains like Bitcoin, Ethereum, and the like. These native tokens – also referred to as protocol tokens – are part of the incentive scheme of blockchain infrastructure. The role of the native token in a blockchain, therefore, is to encourage a disparate group of people who do not know or trust each other to organize themselves around the purpose of a specific blockchain (read more: Chapter 1 – Bitcoin, Blockchain, & Other Distributed Ledgers). With the advent of Ethereum, however, tokens have moved up the technology stack and can now be issued on the application layer with a few lines of code. Such application tokens can have simple or complex behaviors attached to them. Ethereum made it particularly easy to issue tokens with a few lines of code. They developed a standardized smart contract, the ERC-20 standard, which defines a common list of rules for Ethereum tokens, including how the tokens are transferred from one Ethereum address to another, and how data within each token is accessed. These relatively simple smart contracts manage the logic and maintain a list of all issued tokens, and can represent any asset that has features of a fungible commodity. A vast majority of early tokens issued on the Ethereum blockchain have been ERC-20 compliant fungible tokens, where every token has an identical value with any other token of the same kind. They can be fungible and therefore easily traded.

Over the last year, however, more complex token standards have emerged that can represent any asset or access rights with special properties. ERC-721 introduced a free and open standard that describes how to build so-called non-fungible tokens on the Ethereum blockchain. This has introduced the era of building more complex features into the tokens. This standard has made it easy to create a token that represents any type of collectible, artwork, property, or personalized access rights, just to name a few examples. These non-fungible tokens have special properties that make the token unique, or that are tied to the identity of a certain person, and therefore represent less fungible or non-fungible assets and access rights. They might pave the way for one of the most interesting use cases. ERC-721 introduced a much richer spectrum of smart contract standards that exceed the possibilities of the fungible tokens that dominated the early days of token sales (read more: Chapter 3 – Token Sales).

Tokens currently do not cross networks, as they are issued and managed by blockchain-specific smart contracts. These different blockchains have different standards and are o en not interoperable. However, token interoperability is an issue that is being tackled by projects like “Cosmos” and “Polkadot” that are currently emerging. Interoperability and standardization play into potential network effects of mass adoption of tokens. The different standards currently make it infeasible for wallet developers to provide multi-token wallets. Users will have different wallets for different tokens. The lack of multi-token wallets is one of the bottlenecks to usability of handling multiple tokens in one single so ware.

Types of Tokens

Native tokens of state of the art public & permissionless Blockchains like Bitcoin or Ethereum, are part of the incentive scheme to encourage a disparate group of people who do not know or trust each other organize themselves around the purpose of a specific blockchain. The native token of the Bitcoin network also referred to as Bitcoin, has token governance rulesets based on crypto-economic incentive mechanisms that determine under which circumstances Bitcoin transactions are validated and new blocks are created.

These blockchain-based cryptographic tokens enable “distributed Internet tribes” to emerge. As opposed to traditional companies that are structured in a top manner with many layers of management (bureaucratic coordination), blockchain disrupt classic top-down governance structures with decentralized autonomous organizations (DAOs). DAOs bound people together not by a legal entity and formal contracts, but instead by cryptographic tokens (incentives) and fully transparent rules that are written into the software.

The Bitcoin Network can be seen as the first true DAO that provides an infrastructure for money without banks and bank managers and has stayed attack resistant as well as fault-tolerant since the first block was created in 2009. No central entity controls Bitcoin. In theory, only a worldwide power outage could shut down Bitcoin. With the advent of Ethereum however, tokens have moved up the technology stack and can now be issued on the application layer as dApp tokens or DAO tokens. Smart contracts on the Ethereum Blockchain enable the creation of tokens with complex behaviors attached to them. Today, the token concept is central to most social and economic innovations developed with blockchain technology.

Only permissionless ledgers (public Blockchains like Bitcoin or Ethereum) need some sort of incentive mechanism to guarantee that block validators do their job according to the predefined rules. In permissioned (federated/consortium/private) distributed ledger systems, validators and block-creators may be doing their job for different reasons: i.e., if they are contractually obligated to do so. In permissioned environments, validators can only be members of the club and are manually and centrally controlled. Permissioned ledgers, therefore, don’t need a token. Also, please note that the term blockchain in the context of such ledgers is highly controversial.

Trending Technologies 2020

Why SAFEBOXTM Document Sharing is Ideal for Your Professional Needs

As a notary public, you are tasked with handling numerous legal procedures, each involved with different types of documents. Without a legitimate document sharing platform, your job can become tiring due to a lack of an efficient file sharing technique. Furthermore,...

Easy Document Sharing for Notary Publics with SAFEBOXTM

SAFEBOXTM gives you a platform to handle all your document sharing responsibilities hassle-free. It's easy, fast, secure, and reliable. As a notary public, you get to deal with sensitive information daily. SAFEBOXTM ensures that all your data is secure from...

Trends in Document Sharing Technology

The world is undergoing a fast-paced change in technology, which is revolutionizing how things around us work. In particular, the 21st century has seen a proliferation in smart devices, with new inventions coming up every day. One factor that has been subject to...

Security Issues with Document Sharing Technologies

Today, the corporate world is undergoing a swift change in operations, a feat that has been greatly influenced by technological advances. Employees are using different techniques to transfer important documents to clients and fellow workers. This has revolutionized...

How Can Blockchain Technology Improve Data Storage?

Decentralized Cloud Storage Cloud storage systems maintain data on remote servers that are accessible from the internet. However, unlike conventional cloud servers, decentralized cloud storage does not keep user data on a single centralized server. A decentralized...

Our Latest Updates

Why SAFEBOXTM Document Sharing is Ideal for Your Professional Needs

As a notary public, you are tasked with handling numerous legal procedures, each involved with different types of documents. Without a legitimate document sharing platform, your job can become tiring due to a lack of an efficient file sharing technique. Furthermore,...

Easy Document Sharing for Notary Publics with SAFEBOXTM

SAFEBOXTM gives you a platform to handle all your document sharing responsibilities hassle-free. It's easy, fast, secure, and reliable. As a notary public, you get to deal with sensitive information daily. SAFEBOXTM ensures that all your data is secure from...

Trends in Document Sharing Technology

The world is undergoing a fast-paced change in technology, which is revolutionizing how things around us work. In particular, the 21st century has seen a proliferation in smart devices, with new inventions coming up every day. One factor that has been subject to...